Renunciation of US citizenship has become increasingly necessary for US citizens that live outside of the US. Indeed, opening a foreign financial account has become nearly impossible if you hold a US passport. Unfortunately, US citizens really are not worth the risk of US sanctions or billion dollar settlements.

However, renunciation of US citizenship is not nearly as taboo or complicated as you may think. Additionally, the benefits of renouncing US citizenship can outweigh the risks by a large margin.

Benefits from Renunciation of US Citizenship

The benefits of renouncing US citizenship are multiple and very substantial, not only financial. Obviously, you no longer pay US income tax if you do not live or work inside the United States. Additionally, you are free to open financial accounts outside the US unencumbered by FATCA or FBAR regulations.

Fiscal sustainability is another glaring reason to renounce US citizenship. How long will the US be able to run trillion dollar account deficits? As long as foreign countries such as China, Japan and South Korea continue to buy US treasuries, the collapse of the US dollar can be delayed. However, when a run on the US dollar does occur, it is best to have an established escape route.

But what about political benefits? When asked why they are acquiring second passports, most applicants from the US will respond that the political situation in the United States is a dead end. Indeed, this point is hard to argue against. Populist politics and political intransigence on both sides of congress are getting worse, not better. Demonizing “rich people” and implementing infinite middle class bailouts is certainly a “dead end”.

Furthermore, it is increasingly dangerous for US citizens to travel outside the US with their US passport. If you were a citizen of the Middle East, Russia, North Korea, China or Venezuela, how would you feel towards American citizens? Indeed, there are an increasing number of countries who have reason to harm Americans traveling abroad.

History of US Renunciation

Throughout feudal times the doctrine of perpetual allegiance applied to all of those who acquired dual citizenship. As a result, British immigrants to America were still held accountable as British citizens. Unfortunately, this resulted in severe diplomatic issues under some circumstances. For example, Britain attempted to enforce conscription on American sailors who they believed were still subjects of the British crown. This misunderstanding led to the War of 1812 and the right of renunciation would be implemented soon thereafter.

The US Congress finally passed the US Expatriation Act in 1868 which gave Americans the right to renounce US citizenship. As a result, many other countries such as Britain followed soon afterwards with similar legislation. Fortunately, the United States still permits its citizens to renounce US citizenship.

Dual Citizenship Requirement

Ironically, dual citizenship is currently a requirement of renunciation. Without proof of second citizenship the US State department will decline requests for renunciation or relinquishment. The legal foundation of this requirement is uncertain because the US Congress did not include it in the existing legislation. Nonetheless, the US Consulate will require validation of your second passport. Be prepared in advance.

The Legal Basis for Renunciation of US Citizenship

According to Title 8 U.S. Code § 1481 there are 7 acts which effectively result in a renunciation of US citizenship provided the person is over 18 years of age and voluntarily completed the qualifying acts with the intention to relinquish US citizenship. However, only 2 of the qualifying acts are commonly used.

- Making a formal oath of renunciation to a diplomatic or consular officer in a foreign office outside the United States in a manner that is prescribed by the Secretary of State. This act is known as “renunciation”.

- Becoming a naturalized citizen of a foreign state by their own application or by application of an authorized agent (with the intent to relinquish US citizenship). This act of renunciation is known as “relinquishment”.

Implications of Title 8 U.S. Code § 1481

In regards to relinquishment, it is of note that Title 8 U.S. Code § 1481 requires the US Secretary of State to presume that dual citizenship was obtained without the requisite intent to relinquish. As a result, it is not necessary to use option 2 because option 1 is sufficient.

Option 2 is far more complex because the person making the request for renunciation must prove they intended to renounce at the time they satisfied the requirements of naturalization. Therefore, if the requisite intent is in doubt, then renunciation will not be approved. If so, the fee for renunciation or relinquishment which is currently $2,350, will not be refunded.

The other 5 acts of renunciation are inapplicable for most US citizens. For example, after turning the age of 18 if you voluntarily: 1) Commit an act of treason against the US government 2) Serve in a foreign military that is hostile to the US government 3) Accept a foreign government post after acquiring dual citizenship 4) Making a formal written request to the US Attorney General from within the United States during time of war or 5) Taking an oath of allegiance to a foreign state or political sub-division thereof.

Implications of Being a Covered Expatriate

There are two categories of US citizenship renunciation – covered expatriates and uncovered expatriates. Basically, you are a covered expatriate if any of the following statements apply:

- You have a net worth of over 2 million USD at the time of your expatriation.

- Your average annual net income tax for the 5 years ending before the date of expatriation is more than a specified amount that is adjusted for inflation ($162,000 for 2017, $165,000 for 2018, $168,000 for 2019, and $171,000 for 2020).

- You fail to certify on IRS form 8854 that you have fully complied with US tax regulations for the five year period prior to the date of renunciation.

If you are deemed to be a covered expatriate, it means that all of your assets are considered being sold on the day before you renounce US citizenship. The sale value of your assets is calculated using mark to market and you are liable for tax on the income from the purported sale. As a result, if you are a covered expatriate, you should probably have good legal representation. This can be expensive and completely redundant if you are not a covered expat.

Indeed, the process for renunciation of US citizenship is much less complicated if you are uncovered.

Appearance at a US Consulate Outside the US

To complete renunciation of US citizenship, you must appear in person at a US consulate outside of the United States. Take note that you need to choose the right consulate for your renunciation, this is known informally as “embassy shopping”. In short, choose a US consulate that is not hostile to the renunciation process. Otherwise, your renunciation could get botched which could create serious complications. If the foreign country where the US consulate is located has good diplomatic relations with the US government, it is probably OK. If not, proceed with caution.

At the consulate, you should assume they will verify that you are in possession of a valid second citizenship. So bring your second passport or at least have a copy of the bio page. Additionally, have form DS-4080 and DS-4081 correctly filled out, but do not sign the forms until the consulate officer instructs you to do so. You also need to pay the renunciation fee and take the verbal oath of renunciation at the consulate. Last but not least, you need to surrender your US passport.

Final Steps for Renunciation of US Citizenship

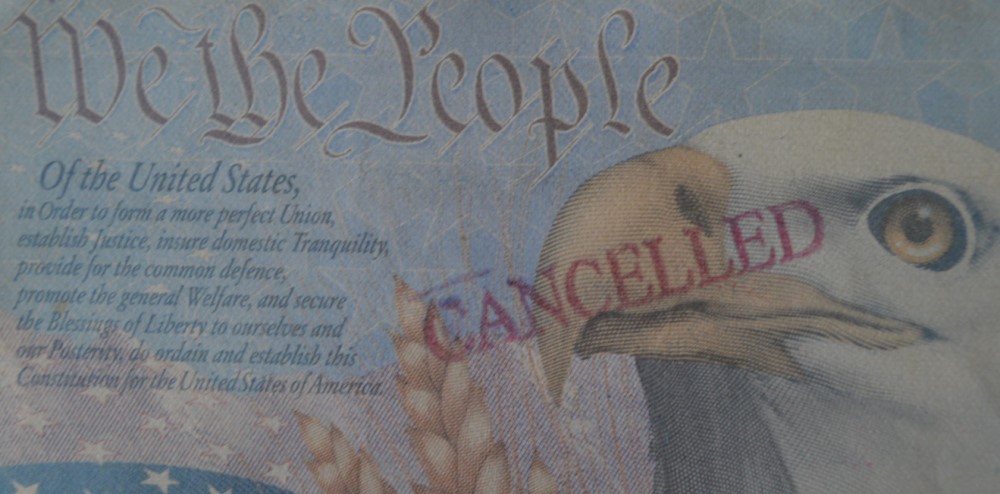

Your request for renunciation is then sent to the US Department of State for certification. Provided there are no red flags e.g. delinquent taxes, in 30-90 days form DS-4083 will be certified and sent back to the consulate for you to pick up along with your canceled US passport.

The certification of form DS-4083 is required as proof that you are not a US citizen. This form is needed for opening foreign financial accounts and other important purposes. Therefore, be sure to preserve the original copy along with your canceled US passport.

Finally, do not forget to file your final US tax return along with IRS form 8854, lest the US government continue to view you as a US citizen for tax purposes.